Verification and Validation Testing for Medical Devices

Verification and Validation (V&V) are two pillars that ensure a medical device is safe, effective, and compliant before it ever […]

Join us at Qt C++ Warsaw Meetup - 21.08.2025

Sign up for free!

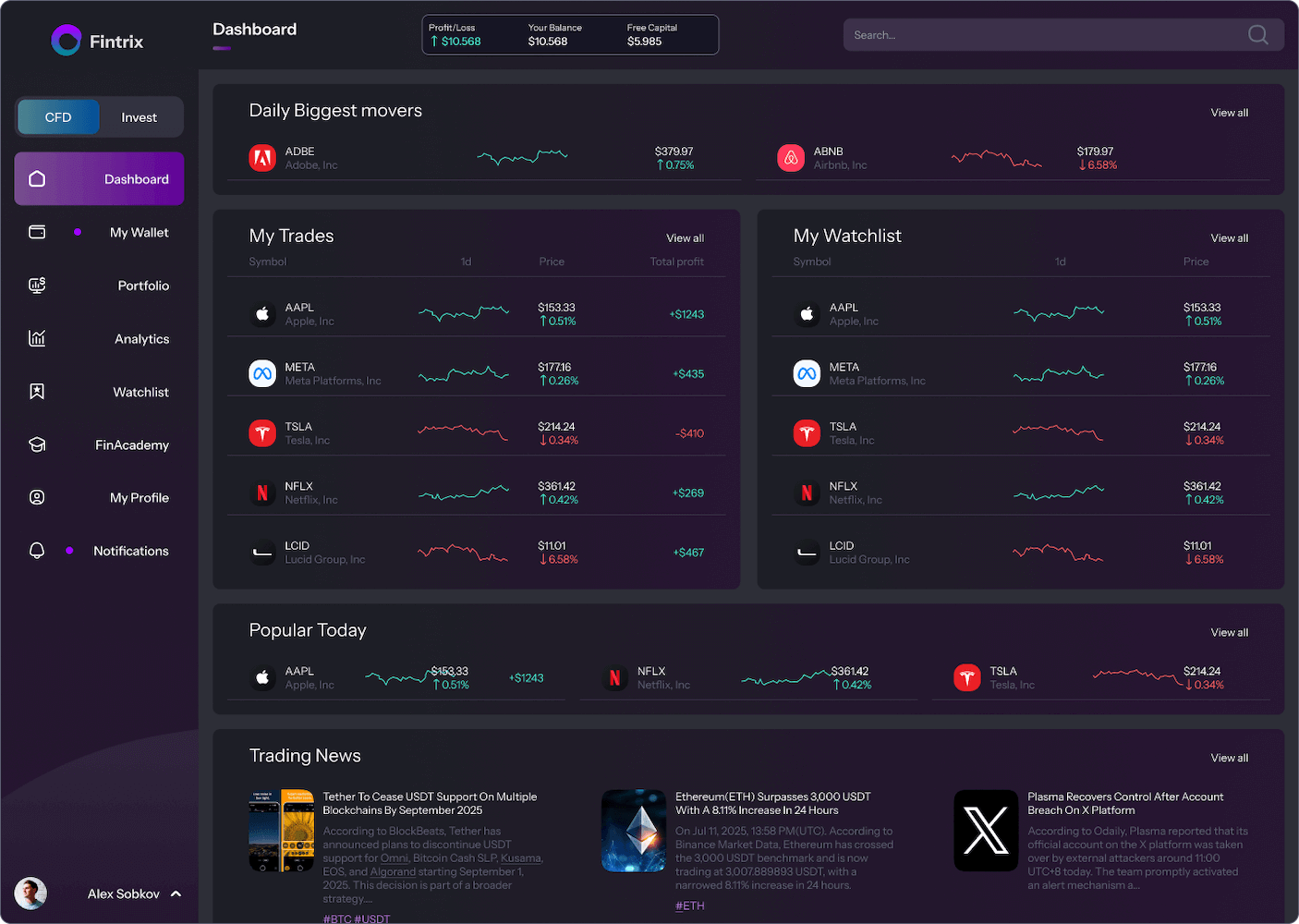

Trading software refers to the digital platforms and systems that enable investors and financial institutions to buy, sell, and manage financial assets online. These platforms have evolved from the days of open-outcry trading floors to sophisticated online systems accessible globally. Modern stock trading software offers capabilities that were unimaginable a few decades ago – from real-time market data and advanced charting tools to social trading features and automated trading algorithms.

Importantly, custom trading software development have democratized access to financial markets, allowing anyone with an internet connection to participate in stocks, forex, crypto, and other assets from the comfort of their home. In short, trading software has transformed how markets operate and who can engage with them.

For companies looking to build trading software solutions in this arena, understanding trading software development is crucial. Whether you’re starting from scratch or improving an existing solution — and whether your focus is on performance, software architecture, a smooth user interface, or integrating real-time data — we’re here to support you at every stage.

Let’s talk about how we can help.

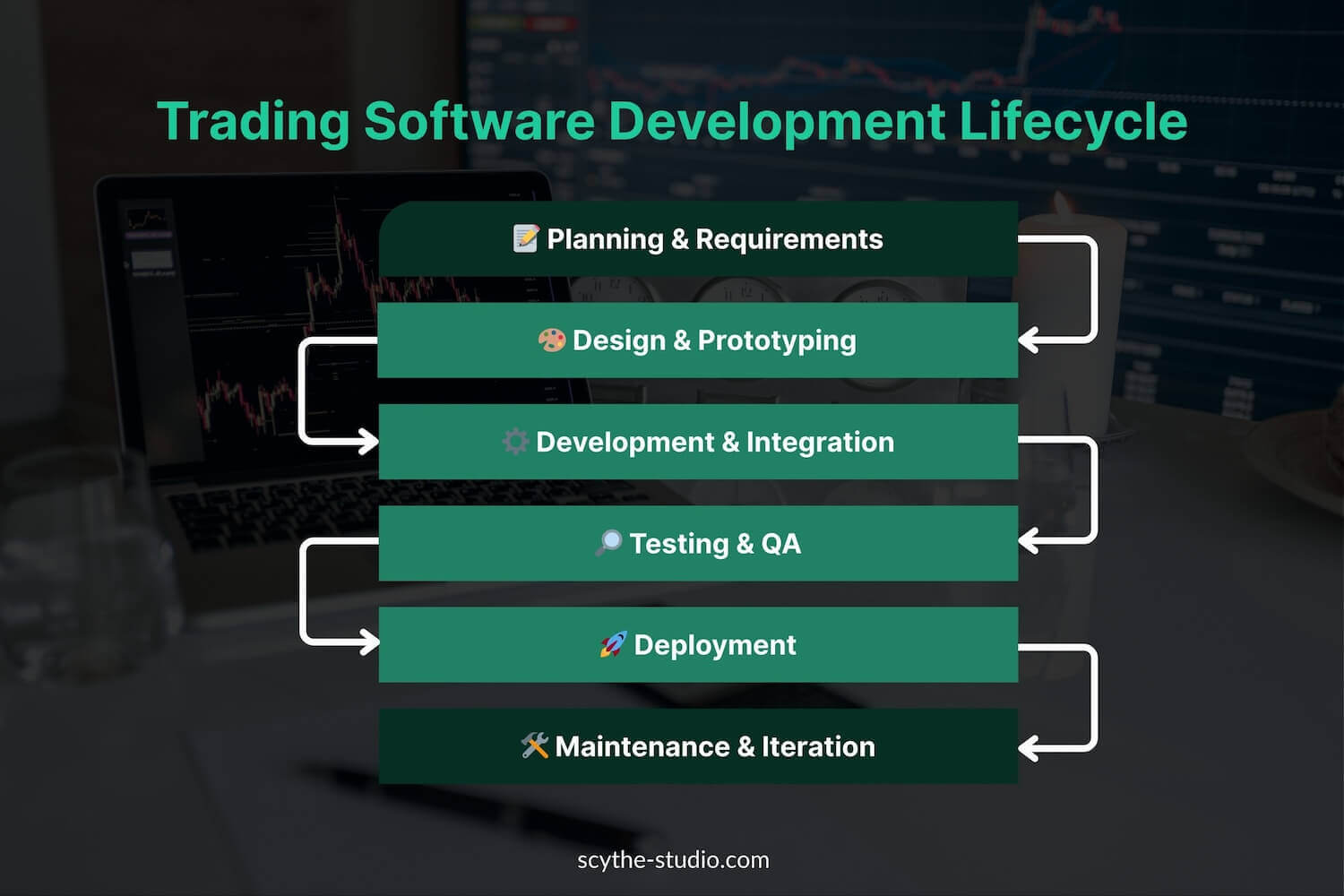

Developing trading software is a complex but structured process. It involves careful planning, specialized technical implementation, rigorous testing, and ongoing iteration to meet the demands of trading industry. Below is a general overview of the development process:

The first step is extensive research and planning. This means defining the target audience and use case for the platform – is it a proprietary desktop system for a brokerage, or a mobile app for retail traders? Understanding the business needs guides the project’s directions. In this phase, you gather requirements, assess regulatory considerations, and outline the core features your trading application needs. It’s also wise to sketch out a business model (e.g. how the platform will make money, such as commissions or subscriptions) early on. This stage establishes the vision and scope of the project.

With requirements in hand, the next step is designing the system. This includes both the system architecture (the technical blueprint of how components will interact) and the user experience. UX/UI designers create wireframes or interactive prototypes of the custom trading platform interface to ensure it’s intuitive and meets user needs. Good design is critical in trading apps – users demand responsive, easy-to-navigate interfaces that can display complex data (charts, order books, etc.) clearly. For a deeper look at how modern trading front-ends are designed, see our guide on trading GUI development. During this stage, some teams develop a proof of concept or MVP (Minimum Viable Product) to validate the idea before full development. Early feedback from stakeholders or beta users can confirm you’re on the right track.

This is the core execution phase where trading platform developers build the system according to the design and specifications. Front-end developers code the client-facing interface (often using languages/frameworks like Qt framework (typically with C++) for cross-platform, JavaScript/TypeScript for web, or Swift/Kotlin for mobile), while back-end developers implement the server-side logic (using robust languages like Python, C#, Java, or C++ suitable for finance). A key aspect is integrating third-party services and APIs – for example, connecting to market data feeds, brokerage execution APIs, news services, and payment gateways. Experienced teams from a trading software development company will also incorporate appropriate tools and ensure performance and compliance throughout. This stage often involves agile workflows and expert input, especially in regulated environments.

Rigorous testing is absolutely crucial in trading platform software development. Financial applications demand high reliability and accuracy – a bug can literally have costly consequences. QA engineers conduct thorough testing including unit tests, integration tests, and system tests to ensure everything works as intended. Special attention is paid to edge cases in trading logic, performance under high load, and security vulnerabilities. Before launch, the platform should also undergo compliance checks (making sure all regulatory requirements are met) and possibly security audits or certifications.

Once the software passes testing, it is deployed to production. Modern trading platform development services often rely on cloud infrastructure to allow on-demand scaling and high availability, though some institutional systems may be on-premises for latency or control reasons. Deploying on cloud infrastructure (AWS, Azure, Google Cloud, etc.) enables flexibility – you can easily add more servers during high traffic (like volatile market days) to maintain performance. Mobile trading apps would be released through app stores, while web-based platforms are hosted online. Deployment also involves setting up monitoring tools to track system health and performance from day one.

Launching the platform is not the end – it’s the beginning of an ongoing maintenance cycle. User feedback is collected and used to fix any post-launch bugs and to guide future enhancements. The development team should be ready to provide support, release regular updates with new features or improvements, and ensure the system scales as the user base grows. Especially in fintech, continuous updates are needed to adapt to new market trends or regulatory shifts, support new asset classes, or leverage emerging data analytics capabilities to refine the platform and deliver more intelligent insights to users. Maintenance also covers operational aspects like ensuring servers are updated and secure, and that backup and disaster recovery plans are in place.

Trading software comes in various forms, each tailored to different users and purposes in the financial markets. When embarking on a trading software project, it’s important to identify what category of system you need to build or what mix of features your target users require. Below are some of the main types of trading software and their characteristics:

Retail trading platforms are consumer-facing applications that allow individual investors (a.k.a. retail traders) to trade securities like stocks, ETFs, forex, or cryptocurrencies. These are the platforms you get when you open an account with an online broker or download a trading app on your phone. Retail platforms prioritize ease of use and accessibility – they often feature user-friendly interfaces, educational resources, and tools suitable for non-professional traders. Retail traders typically access markets through brokerages, so the software connects to the broker’s backend to execute trades on the user’s behalf. Examples of popular online trading platforms include Web-based and mobile apps from brokers (like XTB, Robinhood, E*TRADE, or eToro) and trading software like MetaTrader or thinkorswim that individuals can use with their broker accounts. They emphasize simplicity, security, and ease of access, especially compared to the demands of trading companies operating at institutional scale.

Because retail traders operate with their personal funds and generally smaller volumes, retail platforms provide a curated feature set. Common features are price charts, technical indicators, watchlists, news feeds, and basic risk management tools (like the ability to place stop-loss or take-profit orders). Retail platforms often have wider spreads or commissions than institutional systems, and trade executions might be slightly slower or routed through market-makers – but they offer convenience and low barriers to entry. In terms of software characteristics, retail trading apps usually support multi-device access (web, smartphone, possibly desktop), secure account management, and integration with payment systems for deposits/withdrawals. They also implement Know-Your-Customer (KYC) checks during onboarding to comply with regulations, just like banking apps.

Overall, retail platforms aim to make trading intuitive and achievable for the masses, wrapping powerful market access in a user-centric design.

Institutional trading systems are high-end platforms used by professional traders and large financial organizations – such as investment banks, hedge funds, asset managers, or proprietary trading firms. These systems handle large trade volumes and often connect directly to exchanges or dark pools to execute orders with minimal latency. Institutional platforms are typically far more complex under the hood, offering advanced functionality that caters to experienced traders and institutional workflows. They often support a variety of advanced trading strategies, large trade blocks, and integrations with OMS/RMS systems for professional execution and risk control. For instance, an institutional trading system might integrate with an Order Management System (OMS) or Risk Management System, provide algorithmic execution strategies, and support a wide range of asset classes (equities, bonds, derivatives, etc.) in one place.

Key features of institutional software include direct market access, high-speed order routing, and the ability to handle large block trades or high-frequency orders. Institutional traders often use specialized interfaces (or even custom-built software) that allow for rapid order entry, complex order types, and real-time position/risk monitoring across all their accounts. Because these traders deal with others’ capital or large funds, they benefit from lower fees and tighter spreads on trades, which the software can factor into its execution logic. Another hallmark is depth of data – institutional platforms provide comprehensive market data (multiple levels of order book depth, advanced analytics) and integration of research or news tailored for professionals.

From a development perspective, building institutional trading software means prioritizing performance, stability, and integration. The system may need to interface with multiple exchanges via low-latency APIs or the FIX protocol, handle thousands of orders per second, and enforce risk limits in real-time to prevent costly errors. As a form of mission-critical financial software, it must also comply with stringent regulatory requirements and support internal audit trails.

Algorithmic trading systems (also known as automated trading or black-box trading systems) are platforms focused on executing trades automatically based on pre-programmed strategies. Instead of human traders clicking buy/sell, an algorithmic system generates and routes orders by following a defined set of rules or by reacting to market data in real time. These systems can range from simple retail auto-trading bots (for example, a retail trader using a MetaTrader Expert Advisor to automate a strategy) to extremely complex high-frequency trading (HFT) engines operated by quantitative hedge funds.

The primary goal of algorithmic trading software is to leverage the speed and consistency of computers to capture trading opportunities that humans might miss. Algorithms can monitor markets 24/7, scan hundreds of instruments simultaneously, and execute orders in fractions of a second based on signals. Common strategies implemented by algorithmic systems include trend-following, arbitrage, market making, statistical arbitrage, and many others. Many fall under high-frequency trading, characterized by very high turnover and very short holding periods, where being milliseconds faster than competitors can be profitable.

In terms of features, an algorithmic trading platform usually provides the ability to develop and test strategies (often through programming or a scripting language), connect to real-time data feeds, and then automate trade execution on one or multiple markets. For example, a user might link their bot to a stock trading platform to execute trades based on moving average crossovers or volume spikes. Backtesting is a crucial capability: users (or quants) need to simulate how their algorithms would have performed on historical data to validate a strategy’s effectiveness before risking real capital. Robust risk controls are also important – for example, the system might pause trading if losses exceed a threshold or if it detects abnormal conditions, to prevent unchecked algorithmic behavior that could cause a flash crash.

When building algorithmic trading software, developers must focus on performance, accuracy, and flexibility. The system should be able to handle real-time event processing with minimal latency, interface with various data sources and broker APIs, and allow users to implement custom logic. Many algorithmic platforms offer APIs or SDKs so that sophisticated users can write their own programs to run on the platform. Additionally, monitoring and fail-safes are key: the platform should monitor for glitches (for example, the “infinite money” bug mentioned earlier that one algorithmic glitch created) and enforce safeguards to avoid catastrophic losses or breaches of compliance.

With the rise of digital assets, cryptocurrency trading applications have become another important category of trading software. These applications allow users to trade cryptocurrencies (like Bitcoin, Ethereum, and thousands of other coins/tokens) on crypto exchanges or brokerage platforms. In many ways, crypto trading apps resemble traditional stock trading apps – they provide charts, order placement, portfolio tracking, etc. – but they also have unique considerations due to the nature of crypto assets and markets.

A major aspect of crypto trading software is wallet integration. Unlike stocks which are held by your broker, cryptocurrencies can be held in digital wallets. A robust crypto trading app will often include or connect to a wallet so that users can securely store their crypto assets or transfer them in and out of the platform. Security here is paramount: the software should use strong encryption and best practices to protect users’ private keys or custody assets, given the prevalence of hacks in the crypto space. Two-factor authentication (2FA) and other security protocols (like biometric login or hardware wallet support) are commonly integrated features.

Crypto trading platforms also typically support a wide range of trading pairs and operate 24/7 (crypto markets never close, unlike stock markets). This means the software must handle continuous real-time data and perhaps higher volatility. Features like real-time price alerts are especially useful when the market can move drastically at any hour. Many crypto trading apps provide not just spot trading (buy/sell actual coins) but also derivatives trading (futures, options on crypto) and margin trading; this adds complexity in terms of risk management and regulatory compliance. Speaking of compliance, the crypto industry is getting increasingly regulated – reputable crypto trading software will include KYC/AML verification steps for users and comply with any licensing requirements in the regions they operate, similar to traditional trading apps.

In terms of user experience, crypto apps often aim to be beginner-friendly since many users are new to investing. They may include educational content on blockchain and trading, simple modes for buying crypto instantly, and portfolio tracking that shows the value of a user’s holdings over time in their local currency. Integration with fiat payment systems is another component (letting users deposit money from a bank or credit card to buy crypto). On the backend, a crypto trading system needs to interface with multiple cryptocurrency exchanges or liquidity providers if it offers a wide range of assets – this can be done through exchange APIs. For example, a crypto trading app might aggregate prices from several exchanges to get the best execution for the user. Additionally, since blockchain transactions can be involved (for withdrawals/deposits), the software might interact with blockchain nodes or services.

Overall, building a crypto trading application involves a blend of traditional trading platform features and new challenges specific to digital assets. The end result should be a secure, scalable app that lets users trade crypto with confidence. Core features generally include user registration & verification, real-time market data for crypto prices, order execution engine, wallet management, portfolio overview, and robust security measures. With the continued growth of the crypto market, many fintech companies are exploring this space, and users have come to expect the same level of polish and safety in crypto apps as they do in traditional finance apps.

Regardless of type, there are certain key features and capabilities that nearly all successful trading software platforms need. When designing a trading system, companies should pay special attention to implementing these essential features, as they enable effective and secure trading operations:

Trading software development sits at the intersection of finance and technology, requiring careful planning, domain knowledge, and technical excellence. In financial industry, a well-built trading platform can open new opportunities – whether it’s empowering retail investors with a user-friendly app or giving institutions a cutting-edge tool to execute strategies.

But with the right team, you can turn a complex idea into a powerful, scalable trading solution that stands out in the fintech market. Ready to make it happen? Let’s talk.

Let's face it? It is a challenge to get top Qt QML developers on board. Help yourself and start the collaboration with Scythe Studio - real experts in Qt C++ framework.

Discover our capabilities

Verification and Validation (V&V) are two pillars that ensure a medical device is safe, effective, and compliant before it ever […]

From medical devices and smart vehicles to industrial controllers and consumer electronics, embedded systems are everywhere—and increasingly connected. But with […]

Hey, welcome back to another blog post. Today we’re going to talk about the new Qt WebAssembly. This post will […]