Cybersecurity for Embedded Systems

From medical devices and smart vehicles to industrial controllers and consumer electronics, embedded systems are everywhere—and increasingly connected. But with […]

Join us at Qt C++ Warsaw Meetup - 21.08.2025

Sign up for free!

Technology has always been key in finance, especially in trading, where milliseconds can make or break profits. Of all the tech solutions out there, graphical user interfaces (GUIs) are crucial in trading apps. Whether you’re an individual trader tracking market moves or an institution executing high-frequency trades, the GUI you use directly influences how quickly and accurately you make decisions.

This article will cover key aspects of trading GUIs, discuss ways to build them, and explain why technologies like C++ and Qt are especially effective in this area. The financial industry has long embraced technology to stay competitive, particularly in sectors like trading, where milliseconds can mean the difference between profit and loss. Among all tech solutions, the graphical user interface (GUI) plays an integral role in trading applications. Whether you’re a trader closely monitoring market conditions or an institution handling high-frequency transactions, the user interface you interact with is your gateway to making informed, quick, and efficient decisions.

Looking for experienced developers to develop a trading application? Explore our Qt Development services and see how Scythe Studio can help you with trading apps.

A Trading GUI (Graphical User Interface) is a specialized software interface that traders and financial institutions use to interact with real-time market data, conduct order execution, monitor positions, and manage risk. Unlike typical business applications, a trading GUI must react to dynamic market environments with high-frequency data updates and complex user interactions.

These interfaces are vital for users who must act fast, analyze a flood of data in real time, and confirm or cancel order execution decisions with minimal delay. A properly developed trading GUI enhances access to tools, improves efficiency, and helps traders maintain compliance with regulatory and operational standards.

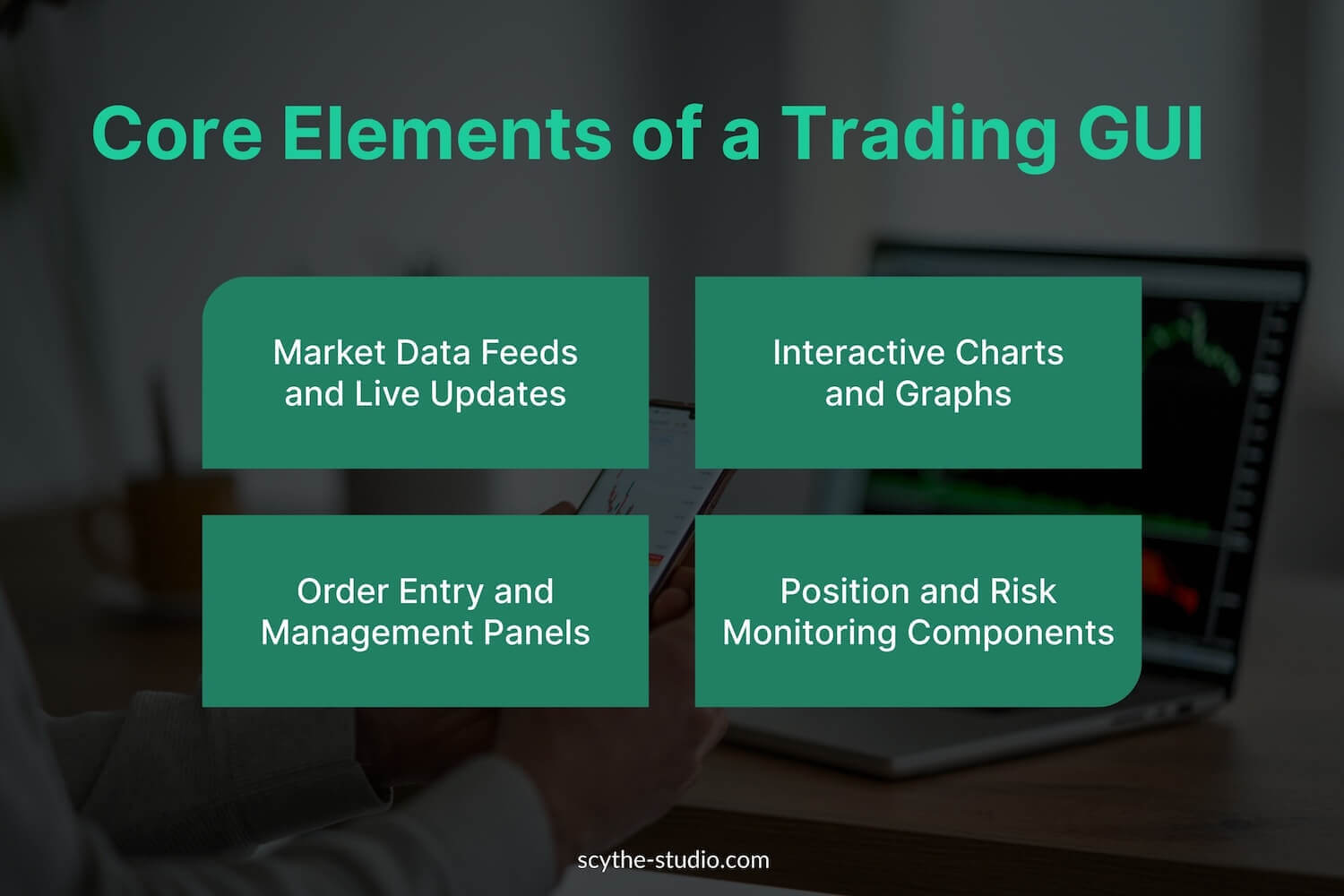

Trading interfaces vary based on use cases and user roles, but some core components show up in almost every serious platform.

Live market data is the backbone of any trading platform. Your GUI must ingest real-time streams of prices, liquidity levels, and transaction history. This data is processed and visualized on the fly, enabling users to spot opportunities or risks as they emerge. Without ultra-low-latency feeds, order execution accuracy and speed are severely compromised.

Advanced charting capabilities are essential for analyzing trends and building a strategy. Traders need customizable charts (candlestick, line, bar) and overlays like moving averages, Bollinger Bands, and RSI. These visualizations should support real-time updates and interactivity (zoom, scroll, filter), allowing users to extract insights from data as market conditions shift.

A robust order entry system supports different order types with configurable settings like duration, quantity, and price. Users must be able to execute, modify, or cancel orders instantly. Efficient management panels also allow for bulk actions and batch execution, all while minimizing the chance of human mistakes.

Risk management is crucial for traders and institutions. A great graphical user interface in a trading platform must include dashboards for tracking positions, leverage, margin usage, and PnL (Profit and Loss). Highlighting potential exposure areas allows for immediate action, especially during periods of high volatility. This functionality is not just operational; it’s a key component of regulatory compliance.

Developing a GUI for the trading platform is not a one-size-fits-all project. The right approach depends on your target audience, performance requirements, and platform goals.

Native development with C++ is often preferred in financial systems. C++ delivers unparalleled performance, deterministic memory management, and precise control over low-level operations. It also offers optimized handling of concurrent data streams and multithreading, critical for processing real-time feeds and order execution logic.

Many high-frequency trading systems use C++ for their trading platform’s backend and frontend, achieving tight integration and ensuring a consistent, high-performance user experience.

Qt is a powerful cross-platform application framework that works seamlessly with C++. It provides developers with a rich set of UI components and tools to build responsive and intuitive interfaces. Its capabilities include advanced 2D and 3D visualizations, real-time data binding, multithreading, and networking, all of which are vital for a trading platform.

As Qt is built upon C++, you can benefit from its legendary performance, which is a must-have for a lot of features present in almost every trading platform, like order execution or queueing.

Want to learn more about how Qt handles data visualization in finance? Check out our in-depth look at the differences between Qt Graphs and Qt Charts.

Qt’s integrated tools simplify development and reduce time-to-market. More importantly, the resulting GUIs remain fast, stable, and maintainable. With a single codebase, Qt enables deployment to desktop, mobile, and even embedded systems.

In certain cases, a hybrid architecture combining native C++ components with embedded web views can offer the best of both worlds. For example, you might use C++ and Qt for order execution and risk-sensitive views while integrating a web dashboard for reporting or client-access modules.

This approach grants development freedom, but it requires careful design to avoid performance bottlenecks or inconsistent user experiences.

When it comes to building high-performance trading software, the combination of C++ and Qt offers an ideal mix of speed, flexibility, and usability.

While the desktop remains the go-to platform for institutional trading, mobile solutions are becoming increasingly important for retail clients and traders on the go.

Desktop users often work with multiple monitors, viewing several instruments, charts, and analytics at once. Mobile traders, on the other hand, get a much smaller screen. That means fewer simultaneous views and a stronger need for focused, summarized data.

Desktop apps often use keyboard shortcuts, drag-and-drop tools, and multi-window layouts. On mobile, it’s all about touch gestures and simple, thumb-friendly layouts. You’ll need to rethink navigation, controls, and even the information hierarchy.

Desktop users want detail, fast access to multiple instruments, layers of analytics, and complex charts. Mobile users usually want clarity. Show only what matters most, and let them dig deeper when needed.

Let’s look at how these principles play out in real apps.

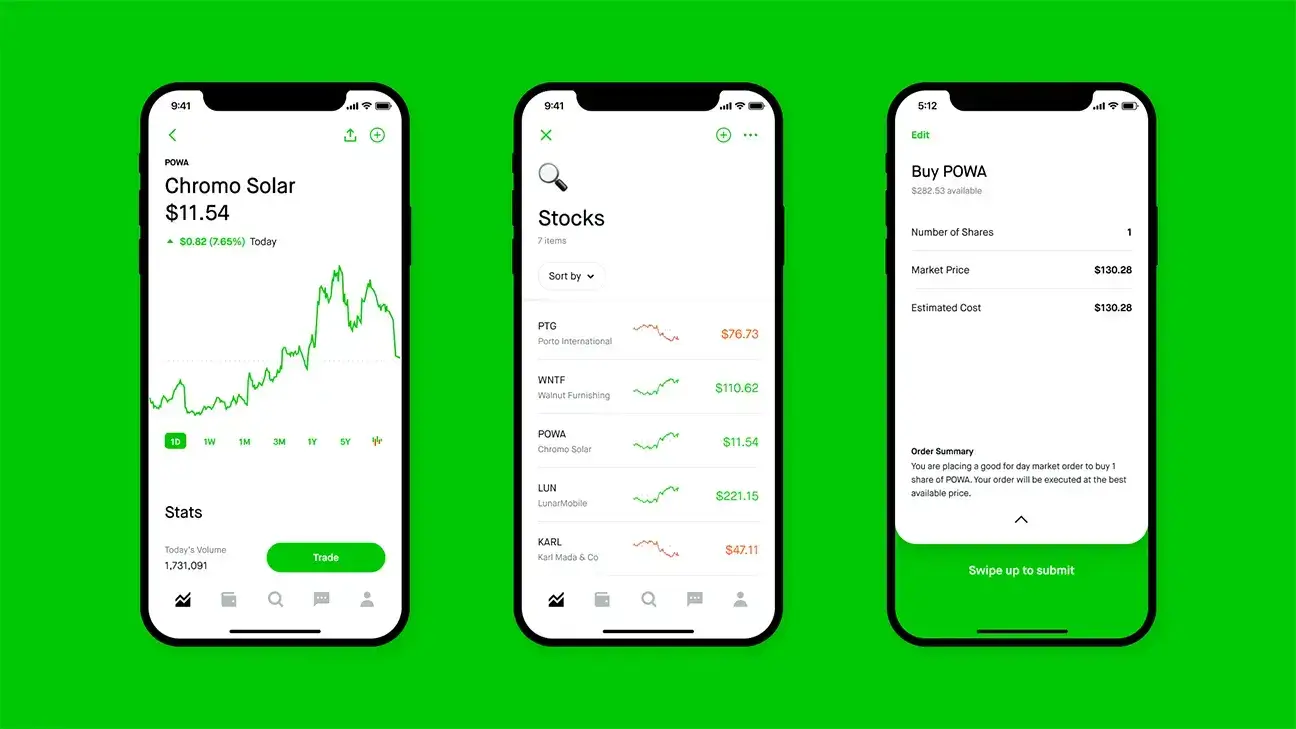

Robinhood’s mobile app represents a particular take on retail trading: low-friction, mobile-first, and built around quick interactions rather than deep analysis. The interface is structured more like a social finance tool than a traditional brokerage platform.

Robinhood’s design emphasizes casual confidence: users are encouraged to place trades without needing to deeply understand execution mechanics. It’s not a tool for strategy development, it’s a gateway into the markets.

The Bloomberg Terminal isn’t just a trading platform, it’s a full-blown financial operating system, deeply embedded in how institutions make decisions, communicate, and manage risk. Its GUI reflects decades of refinement focused on speed, density, and user control.

Where Robinhood offers simplicity by design, Bloomberg offers complexity you can control. Its graphical user interface is less about guiding the user and more about getting out of the way.

So, how do you decide which path to take?

A well-designed trading GUI will not only enhance user experience but will also reduce risk, improve operational accuracy, and provide a competitive edge in today’s fast-moving financial markets.

A reliable, fast, and well-designed graphical user interface for the trading platform is not optional; it’s essential. By using C++ and Qt, you gain the ability to create real-time, responsive interfaces that meet the demands of both institutional and retail traders. Whether you’re optimizing for desktop or mobile, these tools enable robust and elegant software that delivers when it matters most.

Let's face it? It is a challenge to get top Qt QML developers on board. Help yourself and start the collaboration with Scythe Studio - real experts in Qt C++ framework.

Discover our capabilities

From medical devices and smart vehicles to industrial controllers and consumer electronics, embedded systems are everywhere—and increasingly connected. But with […]

Hey, welcome back to another blog post. Today we’re going to talk about the new Qt WebAssembly. This post will […]

Users of embedded devices – from industrial controllers to consumer electronics – are often unaware of hidden vulnerabilities that threaten […]